⚖️ Mark Carney, self-proclaimed anti-Bitcoin, becomes Prime Minister of Canada

Welcome to the Tuesday Daily Tribune on March 11, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today is Tuesday, March 11, 2025, and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

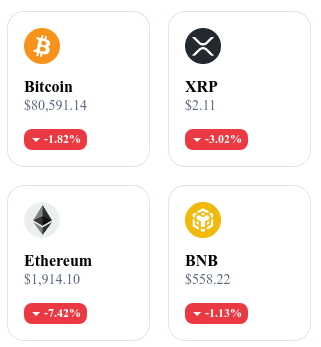

A quick look at the market…

🌡️ Temperature:

Rainy 🌧️

24h crypto recap! ⏱

📉 Wall Street collapses, Bitcoin dives: a signal of crisis?

The brutal drop of Wall Street has pushed Bitcoin below $78,000, marking a 4% drop for the day. The S&P 500 and Nasdaq 100 show respective losses of 2% and 3.5%, while the crypto market as a whole has lost nearly $1 trillion in capitalization in just a few days. Investors are concerned about a possible economic slowdown in the United States, exacerbated by the skyrocketing of gold (+50% in one year) and the continued decline of oil (-20% in two months). At the same time, bond yield volatility complicates the situation further, prompting some players to reduce their exposure to risky assets like cryptos. The upcoming decisions of the Federal Reserve on interest rates could be crucial for market developments. 🔗 Read the full article

🌎 Bitcoin still under-adopted: Only 4% of the global population holds it!

Despite its growing adoption and status as a digital store of value, Bitcoin remains significantly under-represented globally. In 2025, only 4% of the planet's inhabitants own BTC, a figure far lower than many analysts had expected. In the United States, around 14% of the population holds cryptos, compared to barely 1.6% in Africa. Several barriers continue to hinder the mass adoption of Bitcoin: a lack of financial education, perceived excessive volatility, and technological barriers that complicate access for the general public. However, the rise of mobile wallets and the Lightning Network is expected to facilitate its use in the coming years, with a gradual adoption that could accelerate as institutions enter the market. 🔗 Read the full article

🐶 Shiba Inu tries to reassure its community in the midst of a storm

In a market context shaken by strong volatility, Shiba Inu has displayed a surprising resilience, contrasting with the drop of many other cryptos. The team behind SHIB took advantage of this to highlight the solid foundations of the project, emphasizing the importance of its diverse ecosystem, which includes a metaverse, NFTs, and a regular token burn program. Lucie, the marketing manager of the project, did not hesitate to compare Shiba Inu to Bitcoin of memecoins, a statement that generates as much enthusiasm as skepticism within the community. Despite this attempt to reassure investors, analysts remain cautious about the future of SHIB, which remains highly correlated with the dynamics of the altcoin and speculative asset market. 🔗 Read the full article

🇨🇦 Canada takes an anti-Bitcoin turn under Mark Carney

The arrival of Mark Carney as Prime Minister of Canada brings heavy uncertainties regarding the future of cryptos in the country. Former governor of the Bank of Canada and Bank of England, he has always held a firm and critical stance towards Bitcoin, calling its economic model "deficient" and unsuitable for a reserve currency". According to him, a currency must adapt to economic needs and not be restricted by an immutable computer code. His government could thus adopt strict regulations on cryptos and promote the creation of a central bank digital currency (CBDC) to frame the use of digital assets. However, his position on the board of directors of Stripe, a fintech company involved in crypto payments, could push him towards a more nuanced approach than feared. 🔗 Read the full article

Today's crypto: Ultima (ULTIMA)

Ultima is a cryptocurrency designed to make digital assets accessible and user-friendly for all. It is part of a complete ecosystem that includes modern crypto wallets and other innovative products. The main goal of Ultima is to simplify the use of cryptocurrencies, making them practical and accessible to a wide audience.

The native token of Ultima, ULTIMA, is used as a means of payment within its ecosystem, facilitating transactions and access to the products and services offered. ULTIMA holders can benefit from reduced fees and simplified use of decentralized financial services. The initial distribution of ULTIMA was conducted at its launch, with a total supply of 100,000 tokens.

Recent performances:

Current price: $17,803.56 (about €16,800)

24-hour variation: +22.50 %

Market capitalization: $666.01 million

Rank on CoinMarketCap: #205

Why is Bitcoin falling while the dollar collapses? Decoding a financial paradox

Bitcoin is often considered a safe haven against the devaluation of fiat currencies, particularly the U.S. dollar. However, despite a historic decline of the dollar, Bitcoin does not benefit from this context and records an unexpected downward trend. How can this contradiction be explained?

1. A market under pressure: Treasury volatility as the cause

One of the key elements behind this drop lies in the MOVE index, which measures the volatility of U.S. Treasury bonds. Increasing instability of these bonds forces institutional investors to reduce their exposure to risky assets, resulting in a decrease in liquidity in the crypto market.

When Treasury bonds become uncertain, lenders increase margin requirements (haircuts), thus limiting access to credit and forcing financial players to liquidate their most volatile assets, including Bitcoin.

"Bitcoin, despite its status as a theoretical safe haven, suffers from the repercussions of tensions in the bond market." – Jamie Coutts, analyst at Real Vision

2. Widening bond spreads: a worrying signal

Another key indicator is the widening spreads of corporate bonds, which measures the gap between corporate rates and those of Treasury bonds. This phenomenon, observed for the past three weeks, has historically preceded major corrections of Bitcoin.

When these spreads increase, institutional investors reduce their exposure to credit, leading to a domino effect:

Less credit available → Less liquidity for risk markets

Departure of hedge funds and institutional investors from the crypto market

Bitcoin perceived as a too volatile asset in times of uncertainty

This dynamic has led large investors to favor cash, even in weakened dollars, rather than maintaining positions on Bitcoin.

3. Why doesn’t Bitcoin react like before?

In 2024-2025, the crypto market changed with the arrival of Bitcoin Spot ETFs, the rise of institutional miners, and new accumulation strategies, such as that of Michael Saylor (MicroStrategy). However, despite these evolutions, Bitcoin remains sensitive to the movements of traditional markets, especially when credit tensions increase.

This paradox shows that Bitcoin is not yet completely independent of global financial dynamics and that it can be affected by the liquidity arbitrages of institutional investors.

Towards a trend reversal?

If tensions in the bond market stabilize and investors return to alternative assets, Bitcoin could rebound. But for now, financial uncertainties and institutional caution hinder its ascent, despite a dollar losing ground.