🚀 VanEck Bitcoin ETF explodes by 2200%

Welcome to the Daily Tribune on Thursday, February 22, 2024 ☕️

Hello Cointribe! 🚀

Today is Thursday, February 22, 2024, and like every day from Tuesday to Saturday, we summarize the news of the past 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

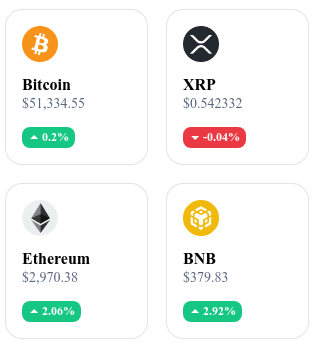

A quick look at the market…

🌡️ Temperature:

Partly cloudy ⛅

24-hour crypto summary ! ⏱️

🚀 VanEck Bitcoin ETF explodes by 2200%! BlackRock worried!

The cryptocurrency market has recently been the scene of an unprecedented frenzy, with the VanEck Bitcoin ETF (HODL) seeing its trading volumes skyrocket by over 2200% in a single day. This explosion has propelled HODL to become the most traded ETF in the market, just behind the giants that are Grayscale's GBTC and BlackRock's IBIT. The origin of this rapid rise appears to be the collective action of a multitude of retail traders, rather than the intervention of a large institutional investor.

In anticipation of this rush, VanEck announced a reduction in fees on HODL, going from 0.25% to 0.20%, which likely attracted even more retail investors. This combination of influential recommendation and cost reduction created an ideal situation for a buying frenzy, pushing Bitcoin ETF volumes to record levels. This event recalls the speculative bubble of 2017 and suggests a renewed interest in Bitcoin.

The spectacular surge of the VanEck Bitcoin ETF reveals an intriguing aspect of investor behavior, oscillating between speculative fervor and the search for increased legitimacy for Bitcoin as an asset class. This phenomenon could be interpreted as the result of a 'crowd mechanic' amplified by social networks, where enthusiasm is often disconnected from fundamental value. However, this event also marks a turning point, suggesting that Bitcoin is crossing the Rubicon, moving from a marginal asset to an essential element of diversified investment portfolios. The question remains: are we witnessing the emergence of a new era of maturity for Bitcoin or a repetition of past speculative cycles?

🚫 Monero officially delisted from Binance! Are regulators worried?

The recent delisting of Monero by Binance sent shockwaves through the cryptocurrency world, highlighting the growing conflict between privacy advocates and government regulators. Monero, known for its untraceable transactions, is at the center of an ideological battle as it represents a direct challenge to regulatory and financial surveillance efforts. Countries like the United States and the United Kingdom have exerted considerable pressure on exchange platforms to remove anonymous cryptocurrencies from their lists, arguing that they facilitate money laundering and illicit activities. Binance's decision to comply with these demands marks a significant turning point in how private cryptocurrencies are perceived and treated in the market.

This action against Monero raises broader questions about the future of anonymous cryptocurrencies, with many experts predicting that regulators may seek to ban them altogether. The measures being considered could range from sanctions on holding Monero to prohibiting its use in certain territories, steps that would inevitably provoke a strong reaction from the crypto community. Such a ban could also incentivize the creation of even more trace-resistant versions of Monero or the emergence of parallel cryptographic networks that escape the control of authorities. The struggle between the desire for privacy and regulatory imperatives is far from resolved, and Monero's case may well be a prelude to larger confrontations to come in the cryptocurrency ecosystem.

The delisting of Monero by Binance is not only a blow to privacy-focused cryptocurrencies; it also serves as a warning for the entire crypto ecosystem, highlighting a growing conflict between the fundamental values of blockchain and regulatory requirements.

💥 Bitcoin ETF - Daily volume surpasses $2 billion!

The world of Bitcoin ETFs is experiencing explosive growth, with a daily trading volume that has recently surpassed $2 billion. This remarkable performance places these funds among the most liquid assets in the market, rivaling large publicly traded companies. The VanEck Bitcoin ETF, in particular, has seen its trading volume increase dramatically, multiplying its usual activity by 15.

This dynamic reflects the growing confidence of investors in crypto assets and marks a significant step towards widespread adoption of Bitcoin by traditional investment channels. The high volumes recorded by Bitcoin ETFs, nicknamed the \"Nine,\" reflect increased investor interest in simplified and secure exposure to cryptocurrency volatility. This trend also highlights the potential impact of decentralized finance (DeFi) on the traditional financial sector, with peer-to-peer financial services threatening to render established financial institutions obsolete. The rise of Bitcoin ETFs in 2024 could mark the beginning of a new era for finance, where transparency and democratization of financial services become the norm.

The rise of Bitcoin ETFs, with volumes exceeding $2 billion, can be celebrated as a victory for mainstream adoption of crypto. However, this evolution is a double-edged sword as it introduces a layer of complexity and systemic risk into an already volatile market. The deep integration of cryptocurrencies into the traditional financial system through instruments like ETFs could lead to interdependence where shocks in the crypto world have broader repercussions on global financial markets.

💰 Bitcoin: Baby boomers are converting to the flagship crypto!

A surprising trend is emerging in the financial ecosystem: baby boomers, traditionally attached to safe assets like gold, are now turning to Bitcoin Spot ETFs. This shift in investment habits among the generation born between 1943 and 1965 marks a significant turning point, especially since gold has long been seen as a hedge against inflation and economic turmoil. The increasing preference for bitcoin among baby boomers raises questions about the motivations behind this change and its future implications for the investment market. According to Bankrate, this age group now holds the largest share of cryptocurrencies, surpassing even younger generations, indicating massive and unexpected adoption of digital assets among older investors.

This shift to Bitcoin Spot ETFs by baby boomers could be attributed to several factors, such as ease of access, diversification potential, and the prospect of high returns.** At the same time, gold is experiencing a decrease in interest, with a continuous decline in investments in gold-backed ETFs, signaling a profound change in investment preferences.** Baby boomers, representing a considerable share of global wealth, could redefine market dynamics by favoring digital assets.

The growing interest of baby boomers in Bitcoin and Bitcoin Spot ETFs can be interpreted in two ways. On the one hand, it marks a changing of the guard in investment preferences, with an increasing recognition of Bitcoin as a legitimate asset and protection against inflation. On the other hand, it could signal irrational exuberance typical of speculative bubbles, where adoption by a traditionally conservative investor base indicates potential overvaluation. This trend deserves special attention to assess whether baby boomers' adoption of Bitcoin is based on a solid understanding of the technology and its advantages or if it is driven by the fear of missing an investment opportunity.

Crypto of the day: SingularityNET (AGIX)

SingularityNET positions itself as a revolutionary blockchain platform focusing on artificial intelligence (AI). Its unique value proposition lies in the creation of a decentralized marketplace for AI services, allowing users and developers to collaborate, exchange, and deploy AI services on a global scale. SingularityNET's native cryptocurrency, AGIX, plays a central role in this ecosystem, facilitating transactions, governance, and incentivizing the contribution of computational resources and AI services. The initial distribution of AGIX was carried out through an initial coin offering (ICO), aiming to distribute tokens fairly among participants while funding the platform's development.

AGIX holders benefit from several advantages, such as the right to vote on important platform decisions, access to premium AI services, and the opportunity to earn passive income by providing AI services or participating in ecosystem governance. AGIX can be used to buy and sell AI services on the SingularityNET marketplace, offering tangible utility and growing demand for the currency.

Recent performance of SingularityNET (AGIX)

Current price: €0.686509

Percentage increase/decrease: 31.11% (1-day increase)

Market capitalization: €862,531,849

Rank on CoinMarketCap: 90

Crypto analysis of the day: Ethereum (ETH)

Ethereum has made headlines once again by surpassing the psychological threshold of $3,000.

First, let's talk about this famous $3,000 threshold. Why is it so important? Well, it's a bit like crossing the finish line of a marathon for Ethereum. It not only demonstrates the strength and resilience of this cryptocurrency in an sometimes turbulent market but also the growing confidence of investors in its potential. The fact that Ethereum rebounded from a correction to $2,160 and reached and surpassed $3,000 is a clear sign that the upward trend is firmly in place. This price level corresponds to the 50% Fibonacci retracement level, a technical indicator often used to predict support and resistance levels. In other words, Ethereum has passed a major test with flying colors!

Now, let's look at the oscillators and the RSI, which are in an overbought zone. This may sound technical, but basically, it means that many people have recently bought Ethereum, which could indicate that the price could soon stabilize or even slightly decrease. But don't worry too much because this is part of the normal cycle of financial markets.

Finally, let's take a look at derivatives and the liquidation heat map. The open interest and positive funding rates show us that speculators are mostly bullish on Ethereum. However, significant liquidation areas below the current price remind us that there is always a risk of volatility.

In conclusion, Ethereum once again shows why it is a pillar of the cryptocurrency world. Of course, the path is paved with challenges and volatility, but the outlook remains promising.